UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

| | | | |

Filed by the Registrant x Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a‑12 |

|

| | | | | | | |

| GREAT WESTERN BANCORP, INC. | | |

| (Name of Registrant as Specified In Its Charter) | | |

| | |

| N/A | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | | |

| | |

| Payment of Filing Fee (Check the appropriate box): | | |

| x | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

GREAT WESTERN BANCORP, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 21, 20194, 2020

To the Stockholders of Great Western Bancorp, Inc.:

You are cordially invited to attend the 20192020 Annual Meeting of Stockholders of Great Western Bancorp, Inc., to be held at the Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, 7500 East Doubletree RanchThe Phoenician, 6000 E. Camelback Road, Scottsdale, Arizona on Thursday,Tuesday, February 21, 2019,4, 2020, at 9:00 a.m. Mountain Standard Time, or any adjournment thereof (the "Annual Meeting"), for the following purposes:

| |

1. | To elect the two nominees for director named in the accompanying proxy statement for the Annual Meeting (the "Proxy Statement") to hold office until the 2022 Annual Meeting of Stockholders; |

| |

2. | To consider an advisory (non-binding) proposal approving the Company's fiscal year 2018 executive compensation as described in the Proxy Statement; |

| |

3. | To ratify the appointment of Ernst & Young LLP to serve as the independent registered public accounting firm for fiscal year 2019; and |

| |

4. | To transact such other business as may properly come before the Annual Meeting. |

1. To elect the three nominees for director named in the accompanying proxy statement for the Annual Meeting (the "Proxy Statement") to hold office until the 2023 Annual Meeting of Stockholders;

2. To consider an advisory (non-binding) proposal approving the Company's fiscal year 2019 executive compensation as described in the Proxy Statement;

3. To ratify the appointment of Ernst & Young LLP to serve as the independent registered public accounting firm for fiscal year 2020; and

4. To transact such other business as may properly come before the Annual Meeting.

The Record Date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting was the close of business on December 28, 2018.9, 2019. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection upon request of any stockholder for a purpose germane to the Annual Meeting at our principal executive offices at 225 S. Main Ave., Sioux Falls, South Dakota 57104 during the ten days prior to the Annual Meeting, during ordinary business hours, and at the Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, 7500 East Doubletree RanchThe Phoenician, 6000 E. Camelback Road, Scottsdale, Arizona, during the Annual Meeting.

We encourage you to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to vote. For instructions on voting, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail or, if you received a hard copy of the Proxy Statement, on the enclosed proxy card. You can choose to receive proxy materials by mail or e-mail if you request them and you continue to have the right to vote by mail, as well as by telephone and on the Internet.

By order of the Board of Directors,

Donald J. Straka

Corporate Secretary

January 11,December 23, 2019

TABLE OF CONTENTS

2020 PROXY STATEMENT SUMMARY

Great Western Bancorp, Inc.

2020 Proxy Statement - Summary

The following summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting.

—————————————————————————————————————————————————————————————————

GENERAL INFORMATION

(See pages 3 through 6)

Meeting: Annual Meeting of Stockholders Date: Tuesday, February 4, 2020 Time: 9:00 a.m. Mountain Time

Location: The Phoenician, 6000 E. Camelback Road, Scottsdale, Arizona

Record Date: December 9, 2019

Voting: Stockholders as of the Record Date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals being voted upon. See page 3 for further information.

Admission: You must provide an admission ticket or proof of stock ownership to enter the meeting.

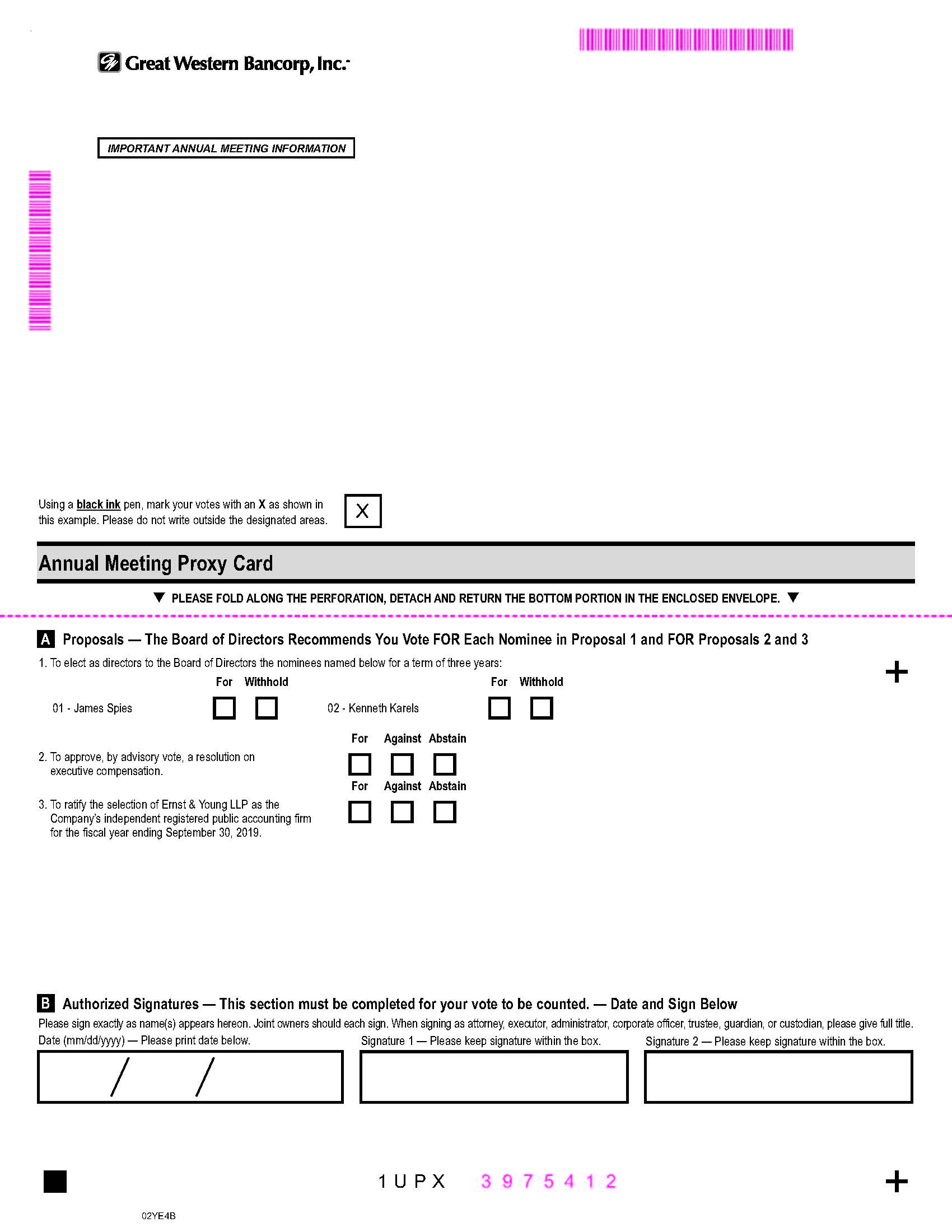

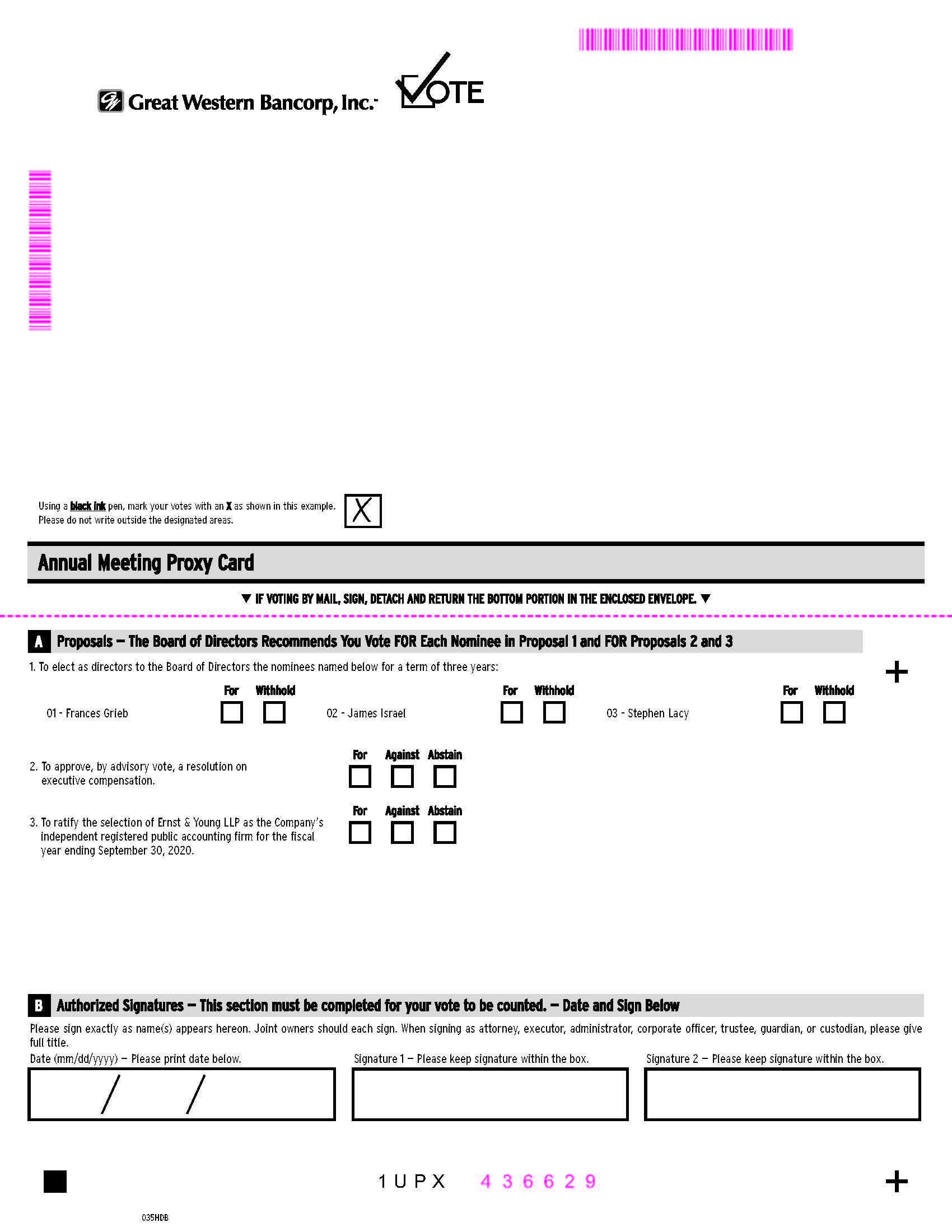

PROPOSALS TO BE VOTED ON AND BOARD VOTING RECOMMENDATIONS

Proposals Recommendation Page References for more detail

—————————————————————————————————————————————————————————————————

| | | | | | | | |

•Election of Directors | FOR Each Director Nominee | |

•Approval of non-binding advisory proposal on Executive Compensation | FOR | |

•Ratification of the appointment of Ernst & Young LLP as independent accountants for 2020 | FOR | |

—————————————————————————————————————————————————————————————————

DIRECTOR NOMINEES

(See pages 19 through 20)

| | | | | | | | | | | | | | |

| Director Name | Age | Director Since | Principal Occupation | Independent |

| Frances Grieb | 59 | 2014 | Retired Deloitte LLP Partner | Yes |

| James Israel | 63 | 2015 | Retired Deere & Co. Executive | Yes |

| Stephen Lacy | 65 | 2015 | Chairman of Meredith Corporation | Yes |

—————————————————————————————————————————————————————————————————

2019 FINANCIAL HIGHLIGHTS

Financial highlights for fiscal year 2019 include:

•EPS increase of 9.4% from 2018;

•Growth of 6.0% in consolidated net income to $167.4 million from 2018;

•Strong profitability with return on average common equity of 9.1% and return on average assets of 1.33% for fiscal year 2019;

•Continued focus on operating efficiency resulting in a strong efficiency ratio of 45.8% for fiscal year 2019;

•Increased loan balances by $290.8 million, or 3.1%, during fiscal year 2019;

•Increased deposit balances by $566.8 million, or 5.8%, during fiscal year 2019; and

•Continued strong capital ratios.

For more details, please see "2019 Business Highlights" on page 24.

—————————————————————————————————————————————————————————————————

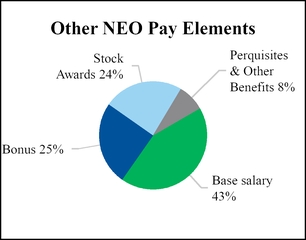

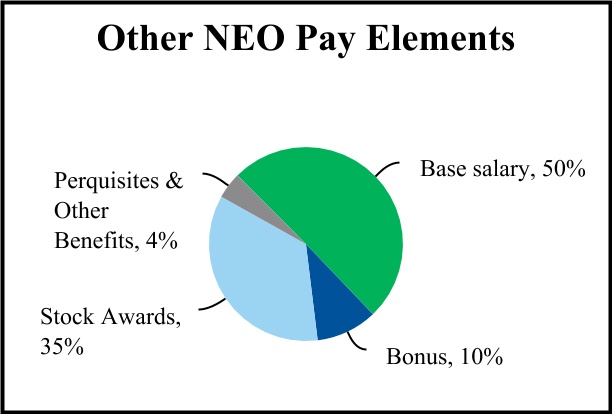

EXECUTIVE COMPENSATION

Set forth below is the fiscal year 2019 compensation for each Named Officer ("NEO") as determined under Securities and Exchange Commission ("SEC") rules. See the notes accompanying the 2019 Summary Compensation Tableon page 34 for additional information.

| | | | | | | | | | | | | | | | | | | | |

Name and

Principal Position | Year | Salary

($) | Stock

Awards

($) | Non-Equity Plan

Compensation

($) | All Other

Compensation

($) | Total

($) |

| Ken Karels | | | | | | |

| Chairperson, President and Chief Executive Officer | 2019 | $ | 825,000 | | $ | 1,219,012 | | $ | 350,625 | | $ | 104,734 | | $ | 2,499,371 | |

| Peter Chapman | | | | | | |

| Executive Vice President and Chief Financial Officer | 2019 | 400,000 | | 369,934 | | 120,000 | | 40,909 | | 930,843 | |

| Doug Bass | | | | | | |

| Executive Vice President and Chief Operating Officer | 2019 | 516,827 | | 491,433 | | 104,325 | | 41,156 | | 1,153,741 | |

| Karlyn Knieriem | | | | | | |

| Executive Vice President and Chief Risk Officer | 2019 | 255,000 | | 102,000 | | 57,375 | | 22,190 | | 436,565 | |

| Timothy Kintner | | | | | | |

| Executive Vice President of the Company and Regional President of our Bank | 2019 | 255,115 | | 100,000 | | 23,130 | | 17,697 | | 395,942 | |

Michael Gough (1) | | | | | | |

| Former Executive Vice President of the Company and Chief Credit Officer of our Bank | 2019 | 260,000 | | 110,241 | | 37,125 | | 23,363 | | 430,729 | |

(1) Mr. Gough ceased to be an executive officer on September 23, 2019 and remains employed with the Company and our Bank in a non-executive officer role.

GREAT WESTERN BANCORP, INC.

225 S. Main Ave.

Sioux Falls, South Dakota 57104

PROXY STATEMENT

FOR THE 20192020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD THURSDAY,TUESDAY, FEBRUARY 21, 20194, 2020

These proxy materials are furnished in connection with the solicitation by the Board of Directors (the “Board” with individual members of the Board being referred to herein as a “director”) of Great Western Bancorp, Inc., a Delaware corporation ("Great Western", "GWB", "we", "our", "us" and "the Company"), of proxies to be voted at the 20192020 Annual Meeting of Stockholders of the Company and at any adjournment of such meeting (the “Annual Meeting”). In accordance with rules and regulations of the Securities and Exchange Commission (the "SEC"), instead of mailing a printed copy of our proxy materials to each stockholder of record, we furnish proxy materials, which include this Proxy Statement (this “Proxy Statement”), and the accompanying proxy card, Notice of Annual Meeting, and Annual Report on Form 10-K for fiscal year ended September 30, 2018,2019, to our stockholders by making such materials available on the Internet unless otherwise instructed by the stockholder. If you received a Notice of Internet Availability of Proxy Materials (the "Notice") by mail and would like to receive a printed copy of our proxy materials by mail or an electronic copy of our proxy materials by email, you should follow the instructions for requesting such materials included in the Notice, which is first being mailed to stockholders on or about January 11,December 23, 2019. The Notice will also contain instructions for accessing our proxy materials on the Internet.

When used in this Proxy Statement, the termterms “our Bank” refersand "the Bank" refer to Great Western Bank, a South Dakota banking corporation and our wholly owned subsidiary, and the term “fiscal year” refers to our fiscal year, which is based on a twelve-month period ending September 30 of each year (e.g., fiscal year 20182019 refers to the twelve-month period ending September 30, 2018)2019).

ABOUT THE MEETING

When and where is the Annual Meeting?

The Annual Meeting will be held on Thursday,Tuesday, February 21, 20194, 2020 at 9:00 a.m. Mountain Standard Time, at the Hyatt Regency Scottsdale Resort & Spa at Gainey Ranch, 7500 East Doubletree RanchThe Phoenician, 6000 E. Camelback Road, Scottsdale, Arizona.

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters described in the Notice of Annual Meeting that accompanies this Proxy Statement, including (i) the election of twothree nominees for director named in this Proxy Statement; (ii) the approval, on an advisory (non-binding) basis, of the Company's executive compensation for fiscal year 2019 as described in this Proxy Statement; and (iii) the ratification of the Audit Committee’s appointment of Ernst & Young LLP as Great Western’s independent registered public accounting firm for fiscal year 2019.2020.

Who may vote at the Annual Meeting?

Only record holders of our common stock, par value $0.01 per share (“Common Stock”), as of the close of business on December 28, 20189, 2019 (the “Record Date”), will be entitled to vote at the Annual Meeting. On the Record Date, the Company had outstanding 56,938,43556,382,915 shares of Common Stock. Each outstanding share of Common Stock entitles the holder to one vote.

What constitutes a quorum?

The Annual Meeting will be held only if a quorum is present. A quorum will be present if a majority of the shares of Common Stock outstanding on the Record Date are represented, in person or by proxy, at the Annual Meeting. Shares represented by properly completed proxy cards either marked “abstain” or “withhold,” or returned without voting instructions, are counted as present for the purpose of determining whether a quorum is present at the Annual Meeting. Also, if shares are represented by properly completed proxy cards, but are held by brokers who are prohibited from exercising discretionary authority for beneficial owners who have not given voting instructions (“broker non-votes”), those shares will be counted as present for the purpose of determining whether a quorum is present at the Annual Meeting.

How do I submit my vote?

If you are a stockholder of record, you can vote by:

•attending the Annual Meeting and voting by ballot;

•signing, dating and mailing in your proxy card which may be obtained by calling 1-866-641-4276 or by emailing investorvote@computershare.com;

•using your telephone, according to the instructions on the Notice or proxy card; or

•visiting http://www.investorvote.com/GWBI and then following the instructions on the screen.

The deadline for voting by telephone or on the Internet is 1:00 a.m. Central Time on February 21, 2019.4, 2020.

What do I do if I hold my shares through a broker, bank or other nominee?

If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the Annual Meeting, you must first obtain a copy of the voting instruction card provided by your broker, bank or nominee or a copy of a brokerage statement showing your ownership of shares as of December 28, 2018.9, 2019.

Can I change or revoke my vote after I submit my vote or return my proxy card?

Yes. If you are a stockholder of record, you may change your vote by:

•voting in person by ballot at the Annual Meeting;

•returning a later-dated proxy card;

•entering a new vote by telephone or on the Internet (prior to 1:00 a.m. Central Time on February 21, 2019)4, 2020); or

•delivering written notice of revocation to the Company’s Corporate Secretary by mail at 225 S. Main Ave., Sioux Falls, South Dakota 57104.

If you vote other than by phone or Internet, you may change your vote at any time before the actual vote takes place at the Annual Meeting. If you vote by phone or Internet, you may change your vote if you do so prior to 1:00 a.m. Central Time on February 21, 2019.4, 2020. If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your vote may be changed.

How are votes counted?

Proposal 1: Election of Directors

A plurality of the votes cast for their election is required for the election of each of the twothree nominees for director. This means that the twothree nominees receiving the highest number of votes will be elected regardless of whether the number of votes received by any such nominee constitutes a majority of the number of votes cast. Votes to withhold and broker non-votes will not be counted for purposes of this proposal and will not affect the result of the vote. Although directors are elected by a plurality of the votes cast, the Board has adopted a Plurality Plus Voting Policy under which any director who fails to receive a favorable majority vote (i.e., more votes "for" election than "withhold" votes) in an uncontested election is required to tender his or her resignation to the Board for acceptance, with the Board to thereafter determine in its discretion whether to accept or reject the resignation. The Board must publicly disclose its decision to accept or reject the resignation and the reasons supporting such decision.

Proposal 2: Approval of an Advisory (Non-Binding) Proposal Approving the Company's Fiscal Year 20182019 Executive Compensation as described in this Proxy Statement

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposal 2 is required for the approval of the advisory (non-binding) proposal on the Company's fiscal year 20182019 executive compensation as described in this Proxy Statement Abstentions will have the same effect as a vote against the proposal. Broker non-votes will have no effect on the outcome of this proposal.

Proposal 3: Ratification of the Appointment of Ernst & Young LLP

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposal 3 is required for the ratification of the appointment of our independent registered public accounting firm.firm for fiscal year 2020. Abstentions will have the effect of voting against this proposal.

Who will count the votes?

The Company’s inspector, Computershare, will count the votes.

Will my vote be kept confidential?

Yes. As a matter of policy, stockholder proxies, ballots and tabulations that identify individual stockholders are kept secret and are available only to the Company, its inspector and proxy solicitor, who are required to acknowledge their obligation to keep your votes confidential.

Who pays to prepare, mail and solicit the proxies?

The Company pays all of the costs of preparing, mailing and soliciting proxies in connection with this Proxy Statement. In addition to soliciting proxies through the mail by means of this Proxy Statement, we may solicit proxies through our directors, officers and employees in person and by telephone, facsimile or email. The Company asks brokers, banks, voting trustees and other nominees and fiduciaries to forward proxy materials to the beneficial owners and to obtain authority to execute proxies. The Company will reimburse the brokers, banks, voting trustees and other nominees and fiduciaries upon request. In addition to solicitation by mail, telephone, facsimile, email or personal contact by its directors, officers and employees, the Company has retained the services of Georgeson Inc., 1290 Avenue of the Americas, 9th Floor, New York, NY 10104, to solicit proxies for a fee of $6,000 plus expenses.

What are the Board’s recommendations as to how I should vote on each proposal?

The Board recommends a vote:

•FOR the election of each of the twothree director nominees named in this Proxy Statement;

•FOR the advisory (non-binding) proposal approving the Company's fiscal year 20182019 executive compensation as described in this Proxy Statement; and

•FOR the ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2019.2020.

How will my shares be voted if I sign, date and return my proxy card?

If you sign, date and return your proxy card and indicate how you would like your shares voted, your shares will be voted as you have instructed. If you sign, date and return your proxy card but do not indicate how you would like your shares voted, your proxy will be voted:

•FOR the election of each of the twothree director nominees named in this Proxy Statement;

•FOR the advisory (non-binding) proposal approving the Company's fiscal year 20182019 executive compensation as described in this Proxy Statement; and

•FOR the ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2019.2020.

With respect to any other business that may properly come before the Annual Meeting, or any adjournment of the Annual Meeting, that is submitted to a vote of the stockholders, including whether or not to adjourn the Annual Meeting, your shares will be voted in accordance with the best judgment of the persons voting the proxies.

How will broker non-votes be treated?

A broker non-vote occurs when a broker who holds its customer’s shares in street name submits proxies for such shares, but indicates that it does not have authority to vote on a particular matter. Generally, this occurs when brokers have not received any voting instructions from their customers. In these cases, the brokers, as the holders of record, are permitted to vote on “routine” matters only, but not on other matters. In this Proxy Statement, brokers who have not received instructions from their customers would only be permitted to vote on the following proposal:

•The ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2019.2020.

Brokers who have not received instructions from their customers would not be permitted to vote on the following proposals:

•To elect the twothree director nominees named in this Proxy Statement; and

•The advisory (non-binding) proposal approving the Company's fiscal year 20182019 executive compensation as described in this Proxy Statement.

We will treat broker non-votes as present to determine whether or not we have a quorum at the Annual Meeting, but they will not be treated as entitled to vote on the proposals, if any, for which the broker indicates it does not have discretionary authority.

What if other matters come up during the Annual Meeting?

If any matters other than those referred to in the Notice of Annual Meeting properly come before the Annual Meeting, the individuals named in the accompanying proxy card will vote the proxies held by them in accordance with their best judgment. The Company is not aware of any business other than the items referred to in the Notice of Annual Meeting that will be considered at the Annual Meeting.

Your vote is important.

Because many stockholders cannot personally attend the Annual Meeting, it is necessary that a large number be represented by proxy in order to satisfy the requirement that a quorum be present to conduct business at the Annual Meeting. Whether or not you plan to attend the meeting in person, prompt voting by proxy will be appreciated. Stockholders of record can vote their shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services are provided in the Notice or on the proxy card. Of course, you may still vote your shares on the proxy card. To do so, we ask that you complete, sign, date and return the enclosed proxy card promptly in the postage-paid envelope.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on February 21, 2019:4, 2020:

This Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended

September 30, 20182019 are Available Free of Charge at:

www.envisionreport.com/GWBI

BOARD OF DIRECTORS, COMMITTEES AND GOVERNANCE

Overview

The Board provides oversight with respect to our overall performance, strategic direction and key corporate policies. It approves major initiatives, advises on key financial and business objectives, and monitors progress with respect to these matters. Members of the Board are kept informed of our business by various reports and documents provided to them on a regular basis, including operating and financial reports made at Board and committee meetings by our Chief Executive Officer ("CEO"), Chief Financial Officer ("CFO"), Chief Risk Officer ("CRO"), Chief Credit Officer ("CCO")executive and other officers. The Board has five standing committees, the principal responsibilities of which are described below under “Committees“Committees of Our Board of Directors.Directors.” Additionally, the independent directors meet in regularly scheduled executive sessions, without Mr. Karels and the other Great Western management present, at each meeting of the Board.

Meetings

The Board met seven13 times in fiscal year 2018,2019, consisting of four regular meetings and threenine special meetings. The Board also took action by written consent two times.one time. Each member of the Board attended more than 75% of the total number of meetings of the Board and the committees on which he or she served. We strongly encourage, but do not require, our Board members to attend annual meetings of our stockholders. Each of the directors then serving attended the 20182019 Annual Meeting of Stockholders held on February 22, 2018.21, 2019.

Board Leadership Structure

We believe that our directors should have the highest professional and personal ethics and values. They should have broad experience at the policy-making level in business, government or banking. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on boards of other companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties, but in no event will a director be permitted to serve on more than four other public company boards (excluding the board of an organization by which he or she is employed). Each director must represent the interests of all stockholders.

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and ChairmanChairperson of the Board, as the Board believes it is in the best interests of the Company for the Board to have the flexibility to make that determination from time to time based on the position and direction of the Company and the membership of the Board. Currently, the Board believes the positions of ChairmanChairperson and Chief Executive Officer should be held by the same person, as this combination is serving the Company well by providing unified leadership and direction.

Mr. Karels currently serves as ChairmanChairperson and Chief Executive Officer of the Company. The Board has determined that this structure presently makes the best use of Mr. Karels' extensive knowledge of the Company and the financial services industry, as well as his ability to foster communication between the Company's management and the Board.

It is the policy of the Board to appoint a lead independent director when the role of ChairmanChairperson and Chief Executive Officer are combined. The Board recognizes that a lead independent director selected by the other independent directors can facilitate the process and controls that support a strong and independent board and strengthen the cohesiveness and effectiveness of the Board as a whole. The lead independent director has the general responsibility to preside at all meetings of the Board when the ChairmanChairperson is not present and during executive sessions of the independent directors. The lead independent director also, among other things, serves as the liaison between the independent directors and the Chairman,Chairperson, and collaborates with the ChairmanChairperson to set meeting schedules and agendas. Our Board believes that this structure combines experience and accountability with effective oversight.

The lead independent director of the Board is chosen by the independent directors of the Board. Thomas E. Henning, who is an independent director under the listing standards adopted by the New York Stock Exchange ("NYSE") and Rule 10A-3 of the Securities Exchange Act of 1934 (the "Exchange Act"), is currently our lead independent director. Mr. Henning has served in this role since February 2017.

Board Oversight of Risk Management

Our Board believes that effective risk management and control processes are critical to our safety and soundness, our ability to predict and manage the challenges that we face and, ultimately, our long-term corporate success. Our Board, both directly and through its committees, is responsible for overseeing our risk management processes, with each of the committees of our Board assuming a different and important role in overseeing the management of the risks we face.

In particular, our Risk Committee oversees our enterprise-wide risk management framework, which establishes our overall risk appetite and risk management strategy and enables our management to understand, manage and report on the risks we face; our Audit Committee is responsible for overseeing risks associated with financial matters (particularly financial reporting, accounting practices and policies, disclosure controls and procedures, and internal control over financial reporting); our Compensation Committee has primary responsibility for risks and exposures associated with our compensation policies, plans and practices, regarding both executive compensation and the compensation structure generally; and our Corporate Governance and Nominating Committee oversees risks associated with the independence of our Board and governance matters. See “Committees“Committees of Our Board of Directors”Directors” for additional information with respect to our Board committees.

In addition, the members of our Board are also members of the Bank's Board of Directors, and as such are actively involved in the Bank's risk oversight activities and the policy approval function of the Board of Directors of the Bank.

Our senior management and Management Risk Committee ("MRC") are responsible for implementing and reporting to our Board regarding our risk management processes, including by assessing and managing the risks we face, including strategic, operational, legal, compliance, technology, regulatory, investment and execution risks, on a day-to-day basis. Our MRC derives its authority from our Risk Committee and its members include our Chief Executive Officer ("CEO") (Chairperson), President, Chief Financial Officer ("CFO"), Chief Operating Officer ("COO"), Chief Risk Officer ("CRO"), Chief Credit Officer ("CCO"), General Counsel, Treasurer, Senior Vice President Operations, Chief Information Officer and Head of People & Culture and Learning & Development. Additionally, the Head of Internal Audit attends meetings in a non-member capacity. Our senior management and MRC are also responsible for creating and recommending to our Board and Risk Committee for approval appropriate risk appetite metrics reflecting the aggregate levels and types of risk we are willing to accept in connection with the operation of our business and pursuit of our business objectives.

The role of our Board in our risk oversight is consistent with our leadership structure, with our Chief Executive OfficerCEO and the other members of senior management having responsibility for assessing and managing our risk exposure, and our Board and its committees providing oversight in connection with those efforts. We believe this division of risk management responsibilities presents a consistent, systemic and effective approach for identifying, managing and mitigating risks throughout our operations.

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines, which are accessible on our website at www.greatwesternbank.com under the Investor Relations tab. These guidelines set forth a framework within which our Board, assisted by Board committees, directs the Company’s affairs. These guidelines address among other things, the composition and functions of our Board, director qualifications and independence, management succession and review, Board committees and selection of director nominees.

Independent Directors and Director Nominees

A director is independent if the Board affirmatively determines that he or she satisfies the independence standards set forth in Section 303A of the NYSE Listed Company Manual, has no material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and is independent within the meaning of Rule 10A-3 of the Exchange Act. The Board has reviewed the independence of our current non-employee directors and nominees and has determined that Ms. Grieb and Messrs. Brannen, Henning, Israel, Lacy, Rykhus and Spies are each an independent director.

Committees of Our Board of Directors

The standing committees of our Board consist of an Audit Committee, a Corporate Governance and Nominating Committee, a Compensation Committee, a Risk Committee and an Executive Committee. The responsibilities of these committees are described below. Our Board may also establish various other committees to assist it in its responsibilities, including Special Committees as deemed appropriate for special purposes. The following table summarizes the membership of the Board and each of its regularstanding committees as of the date of this Proxy Statement.

|

| | | | | | | | | | | | | | | | |

| Director Name | Audit Committee | Corporate Governance & Nominating Committee | Compensation Committee | Risk Committee | Executive Committee |

| James Brannen | Member | | | Chair | |

| Frances Grieb | Chair | | | Member | |

| Thomas Henning | | | | Member | Chair |

| James Israel | Member | | | Member | |

KennethKen Karels | | | | | Member |

| Stephen Lacy | | Chair | Member | | |

| Daniel Rykhus | | Member | Chair | | Member |

| James Spies | | Member | Member | | |

Audit Committee. The Audit Committee assists the Board in fulfilling its oversight responsibilities by providing general oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements as relating to financial reporting, the appointment of our independent auditors, and the performance of our internal audit function and independent auditors. The Head of our Internal Audit reports directly to the Chair of our Audit Committee. Among other things, the Audit Committee:

•appoints, oversees and determines the qualifications, independence and compensation of our independent auditors;

•reviews and discusses our financial statements and the scope of our annual audit to be conducted by our independent auditors and approves all audit fees;

•reviews and discusses our financial reporting activities, including our annual report, and the accounting standards and principles followed in connection with those activities;

•pre-approves audit and non-audit services provided by our independent auditors;

•meets with management and our independent auditors to review and discuss our financial statements, financial disclosure and the adequacy and effectiveness of the Company's internal control over financial reporting and our disclosure controls and procedures;

•establishes and oversees procedures for the treatment of complaints regarding accounting and auditing matters;

•reviews the scope of work and staffing of our internal audit; and

•monitors our legal, ethical and regulatory compliance with a focus on matters impacting the financial statements.

The Audit Committee must consist of at least three members, each of whom must meet financial competency standards and be “independent” under the listing standards of the NYSE and meet the requirements of Rule 10A-3 of the Exchange Act. The members of the Audit Committee include Ms. Grieb (Chairperson) and Messrs. Brannen and Israel, each of whom satisfy the foregoing requirements. The Board has determined that Ms. Grieb, Mr. Brannen and Mr. Israel each qualify as an audit committee financial expert.

The Audit Committee has adopted a written charter that specifies the scope of its rightsauthority and responsibilities, including those listed above. The charter is available on our website at www.greatwesternbank.com under the Investor Relations tab. During fiscal year 2018,2019, the Audit Committee met 11 times consisting of ten times. The Audit Committee also took action by written consentregular meetings and one time.special meeting.

Compensation Committee. The Compensation Committee is responsible for discharging the responsibilities of our Board relating to compensation of our executives and directors and our compensation programs in general. Among other things, the Compensation Committee:

•reviews no less than annually our compensation programs and incentive plans to determine whether they are properly coordinated and achieving their intended purposes;

•reviews our overall compensation philosophy with a view to appropriately balance risk and financial results in a manner that does not encourage employees to expose us to imprudent risks, and is consistent with safety, soundness, the goals and objectives of the plans and the compensation practices of any relevant peer group of competitive companies, and reviews (with input from our Chief Risk Officer) the relationship between risk management policies and practices, corporate strategy and senior executive compensation;

•reviews and oversees executive incentive compensation plans and programs, including any equity-based compensation plans;

•reviews and approves the annual compensation arrangements for our Chief Executive Officer and reviews and recommends to our Board the annual compensation arrangements for our other executive officers;

•monitors talent management and organizational development practices including leadership development and employee engagement;

•oversees the Chief Executive Officer succession planning process and monitors the succession planning practices and strategies to ensure continuous development of talent for executive officers and other key roles; and

•reviews and recommends to our Board any changes in compensation for directors.

The Compensation Committee must consist of at least three members, each of whom must meet NYSE’s independence standards. The members of the Compensation Committee are Messrs. Rykhus (Chairperson), Lacy and Spies, each of whom satisfies the independence standards.

The Compensation Committee has a written charter that specifies the scope of its rightsauthority and responsibilities, including those listed above. The charter is available on our website at www.greatwesternbank.com under the Investor Relations tab. During the fiscal year 2018,2019, the Compensation Committee met five times consisting of four regular meetings and one special meeting. The Compensation Committee also took action by written consent one time.

Corporate Governance and Nominating Committee. The Governance Committee is responsible for ensuring an effective and efficient system of governance by clarifying the roles of our Board and its committees; identifying, evaluating and recommending to our Board candidates for directorships; and reviewing and making recommendations with respect to the size and composition of our Board. In addition, the Governance Committee is responsible for reviewing and overseeing our corporate governance guidelines and for making recommendations to our Board concerning governance matters. Among other things, the Governance Committee:

•identifies individuals qualified to be directors consistent with our corporate governance guidelines and evaluates and recommends director nominees for approval by our Board;

•reviews and makes recommendations to our Board concerning the structure and membership of Board committees;

•develops and annually reviews our corporate governance guidelines;

•oversees the annual self-evaluation of our Board and its committees; and

•oversees risks related to corporate governance.

The Governance Committee must consist of at least three members, each of whom must meet NYSE’s independence standards. The members of the Governance Committee are Messrs. Lacy (Chairperson), Rykhus and Spies, each of whom satisfies the independence standards.

The Governance Committee has a written charter that specifies the scope of its rightsauthority and responsibilities, including those listed above. The charter is available on our website at www.greatwesternbank.com under the Investor Relations tab. During fiscal year 2018,2019, the Governance Committee met five times consisting of four regular meetings and one special meeting.

Risk Committee. The Risk Committee assists the Board in fulfilling its responsibilities for oversight of our enterprise-wide risk management framework, including reviewing our overall risk appetite, risk management strategy, and policies and practices established by our management to identify and manage risks to the Company. Among other things, the Risk Committee:

•reviews reports on and oversees our enterprise-wide risk management framework, including processes and resources necessary for us to execute our risk program effectively;

•considers the alignment of our risk profile with our strategic plan, goals, objectives and risk appetite;

•reviews reports from management on any significant new business or strategic initiatives;

•consults at least on an annual basis with the Chief Executive Officer, Chief Risk Officer and other executive management as required to review and approve our overall risk appetite and ensure oversight to our Board;

•considers, where necessary or appropriate, communications from regulatory authorities, including those pertaining to examinations;

•reviews and approves on an annual basis the Delegated Commitment Authorities frameworks operating across the Company;

•reviews with the Chief Risk Officer and management their assessment of our risk position and profile, matters of note, trends and emerging risks; and

•assists in promoting a risk-based culture and reinforcing achievement of a balance between risk and return.

The Risk Committee must consist of at least three members, a majority of whom must be independent, including the Chairperson. The members of the Risk Committee are Messrs. Brannen (Chairperson), Henning and Israel and Ms. Grieb, each of whom satisfies the independence standards. The Board has determined that Messrs. Brannen, Henning, and Israel have the requisite experience in identifying, assessing and managing risk exposures.

The Risk Committee has a written charter that specifies the scope of its rightsauthority and responsibilities, including those listed above. The charter is available on our website at www.greatwesternbank.com under the Investor Relations tab. During fiscal year 2018,2019, the Risk Committee met five times consisting of four times.regular meetings and one special meeting.

Executive Committee. The Executive Committee is responsible for providing guidance and counsel to our management team on significant matters affecting the Company and taking action on behalf of our Board with respect to matters delegated by the Board or where required in exigent circumstances where it is impracticable or infeasible to convene, or obtain the unanimous written consent of our full Board and in matters delegated by the Board. The members of the Executive Committee are Messrs. Henning (Chairperson), Karels and Rykhus.

The Executive Committee has a written charter that specifies the scope of its rightsauthority and responsibilities, including those listed above. The charter is available on our website at www.greatwesternbank.com under the Investor Relations tab. During fiscal year 2018,2019, the Executive Committee met one time.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee is or has been one of our officers or employees, and none has any relationships with us of the type that is required to be disclosed in this Proxy Statement.Statement under SEC rules. None of our executive officers serves or has served as a member of the board of directors, compensation committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Code of Ethics and Whistle BlowerWhistleblower Policy

Our Board has adopted a Code of Ethics applicable to our principal executive, financial and accounting officers, a code of ethics applicable to all officers, directors and employees, and a Whistle BlowerWhistleblower Policy, all of which are available on our website at www.greatwesternbank.com under the Investor Relations tab. Employees may submit concerns or complaints regarding illegal or fraudulent activity; questionable accounting, internal controls or auditing matters; conflicts of interest, or dishonest or unethical conduct, disclosures in the Company’s reports filed with the SEC, bank regulatory filings and other public disclosures that are not full, fair, accurate, timely or understandable; violations of our code of ethics; and/or any other violations of laws, rules or regulations, on a confidential or non-confidential basis by means, among others, of a toll-free telephone hotline or the use of an internet-based reporting system. Concerns and complaints are to be reported in accordance with such codes and policies, and where appropriate, they are reported to our General Counsel and/or Audit Committee chairperson for review and any required investigation.

Anti-Hedging and Anti-Pledging Policies for Directors and Executive Officers

Under the Company's Insider Trading Policy, directors and executive officers of the Company are prohibited from engaging in short-term or speculative transactions in Company securities including the Common Stock. Such transactions may include buying and selling options (puts or calls) of Company securities on an exchange or in any other organized market. Certain forms of hedging or monetization transactions with respect to Company securities, such as prepaid variable forward contracts, equity swaps, collars and exchange funds are also prohibited. The Company maintains this policy because hedging transactions, which might be considered short-term bets on the movements of the Common Stock, could create the appearance that the person is trading on inside information. In addition, transactions in options may also focus on the person's attention on short-term performance at the expense of our long-term objectives.

The Company's Insider Trading Policy also prohibits its executive officers and directors from holding Company securities in a margin account or otherwise pledging Company securities as collateral for a loan. Securities held in a margin account or as collateral for a loan may be sold without the consent of the executive or the director if the customer fails to meet a margin call or defaults on the loan. The Company maintains this policy because a margin sale or foreclosure sale may occur at a time when the pledger is aware of material non-public information or otherwise is not permitted to trade in Company securities and the margin sale or foreclosure sale of the Company securities during such time could also create the appearance that the person is trading based on insider information. Additional information regarding the Company's anti-hedging and anti-pledging policies is found in the Compensation Discussion & Analysis under "Additional Information Regarding Compensation Policies".

Stockholder Communications with the Board of Directors

The Company has adopted a formal Stockholder Communications Policy for stockholders to send communications to the Board. Communications to one or more directors must be in writing and sent care of the Company's Secretary and General Counsel to 225 S. Main Ave, Sioux Falls, SD 57104 or via email to donald.straka@greatwesternbank.com. Communications to a director must include:

•the name, address, telephone number and e-mail address of the communicator,

•a statement of the type and amount of the securities of the Company that the person holds or the nature of the person's interest in the Company, and

•if the person submitting the communication is not a stockholder and is submitting the communication to the non-management directors as an interested party, the nature of the person’s interest in the Company.

The Company’s Secretary and General Counsel will distribute to the director addressee(s) all communications that, in his or her judgment, are appropriate for consideration by the director(s). Examples of communications that would be considered inappropriate for consideration by the directors include, but are not limited to, commercial solicitations, trivial, obscene or profane items, administrative matters, ordinary business matters, job inquiries, or personal grievances. Correspondence that is not appropriate for Board review will be handled by our Company’s Secretary and General Counsel. All appropriate matters pertaining to accounting or internal controls will be distributed promptly to the attention of the Chairperson of the Audit Committee.

All stockholder communications seeking to nominate a director or other stockholder proposals must be submitted in accordance with applicable law, the Company’s Bylaws and the Company’s Policy for Stockholder Nominations and Proposals. The Company’s Bylaws and Policy for Stockholder Nominations and Proposals are available on our website at www.greatwesternbank.com under the Investor Relations tab.

DIRECTOR COMPENSATION

The following table provides information concerning the compensation of each non-employee director for service on our Board and Board committees in fiscal year 2018.2019. Directors who are employed by the Company or the Bank did not receive, and will not receive, any compensation for their services as directors.

| | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Total |

| James Brannen | $47,500 | | $60,000 | | $107,500 | |

| Frances Grieb | 49,500 | | 60,000 | | 109,500 | |

| Thomas Henning | 62,000 | | 60,000 | | 122,000 | |

| James Israel | 42,000 | | 60,000 | | 102,000 | |

| Stephen Lacy | 42,000 | | 60,000 | | 102,000 | |

| Daniel Rykhus | 46,000 | | 60,000 | | 106,000 | |

| James Spies | 45,000 | | 60,000 | | 105,000 | |

|

| | | |

| Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Total |

| James Brannen | $49,000 | $60,000 | $109,000 |

| Frances Grieb | 51,000 | 60,000 | 111,000 |

| Thomas Henning | 62,000 | 60,000 | 122,000 |

| James Israel | 42,000 | 60,000 | 102,000 |

| Stephen Lacy | 42,000 | 60,000 | 102,000 |

| Daniel Rykhus | 46,000 | 60,000 | 106,000 |

| James Spies | 45,000 | 60,000 | 105,000 |

| |

(1) | The amounts in this column were paid for service through September 30, 2018. |

| |

(2) | Amounts reflect the aggregate value of Company equity-based awards comprised of restricted share units issued to the non-employee directors on December 1, 2017, valued at the closing price of a share of the Company's Common Stock on the grant date, which was $41.07 per share. |

(2) Amounts reflect the aggregate value of Company equity-based awards comprised of restricted share units issued to the non-employee directors on November 30, 2018, valued at the closing price of a share of the Company's Common Stock on the grant date, which was $37.32 per share.

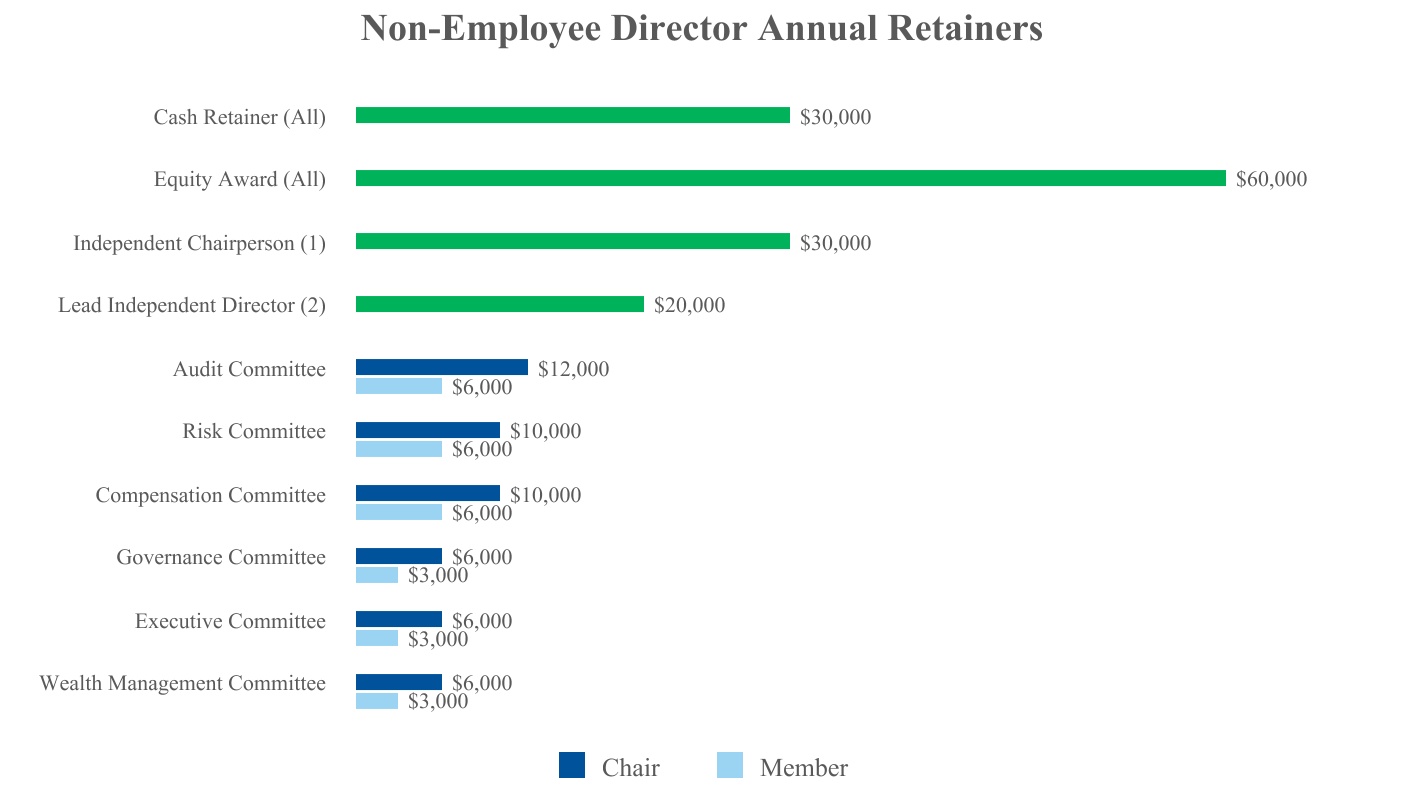

The Board has adopted a directors' compensation program that provides the following compensation for non-employee members of our Board:

(1) Represents compensation that would be paid should the Company appoint an annual cash retainer of $30,000;

an annual cash retainer of an additional $30,000 for an independent Chairperson, if appointed;

an annual cash retainer of an additional $20,000 for a Lead Independent Director, if appointed;

an annual equity award in the form of immediately vested restricted stock units with a value of $60,000;

an additional annual cash retainer of $12,000 for the chairChairperson. During fiscal year 2019, Mr. Karels, President and CEO of the Audit Committee;

an additional annual cash retainer of $10,000 for each of the chairs of the Compensation Committee and Risk Committee;

an additional annual cash retainer of $6,000 for each of the chairs of the Governance Committee, Executive CommitteeCompany and the Bank's Trust Committee; andBank, was appointed to serve as Chairperson.

an additional annual membership fee of $6,000 for each member of the Audit Committee, Compensation Committee and Risk Committee, and of $3,000 for each member of the Governance Committee, Executive Committee and the Bank’s Trust Committee.

(2) In the event the Chairperson is not an independent director, the Board will appoint a Lead Independent Director. During fiscal year 2018,2019, the Company appointed Mr. Henning to serve as Lead Independent Director.

We also reimburse all directors for reasonable out-of-pocket expenses incurred in connection with the performance of their duties as directors, including without limitation travel expenses in connection with their attendance in-person at Board and committee meetings.

Use of Compensation Consultants

The Compensation Committee's charter authorizes it to retain advisors, including compensation consultants, to assist it in its work. The Compensation Committee believes that compensation consultants can provide important market information and perspectives that can help it determine compensation programs that best meet the objectives of our compensation policies. In selecting a consultant, the Committee evaluates the independence of the firm as a whole and of the individual advisors who will be working with the Committee.

Independent Committee Consultant

During fiscal year 2019, the Compensation Committee retained Willis Towers Watson ("WTW") as its independent compensation consultant to review director compensation. WTW has no other business relationship with the Company and receives no payments from us other than fees for services to the Compensation Committee. WTW reports directly to the Compensation Committee, and the Compensation Committee may replace it or hire additional consultants at any time.

The scope of WTW's engagement in fiscal year 2019 included:

•Refreshing the current compensation peer group;

•Reviewing all elements of director compensation (e.g., annual retainers, equity compensation, meeting fees, committee member compensation, committee chair additional compensation, non-executive Chairperson compensation, and Lead Director compensation);

•Evaluating the mix of cash compensation and equity/deferred compensation that makes up total direct compensation (annual cash compensation plus equity); and

•Providing an evaluation of the director compensation program design, including alternative recommendations for consideration in regards to both level and design.

Compensation Committee Assessment of Consultant Conflicts of Interest

The Compensation Committee has reviewed whether the work provided by WTW represents any conflict of interest. Factors considered by the Compensation Committee include: (i) other services provided to the Company by the consultant; (ii) what percentage of the consultant's total revenue is made up of fees from the Company; (iii) policies or procedures of the consultant that are designed to prevent a conflict of interest; (iv) any business or personal relationships between individual consultants involved in the engagement and Committee members; (v) any shares of Company stock owned by individual consultants involved in the engagement; and (vi) any business or personal relationships between our executive officers and the consulting firm or the individual consultants involved in the engagement. Based on its review, the Compensation Committee does not believe that any of the compensation consultants that performed services in fiscal year 2019 has a conflict of interest with respect to the work performed for the Company or the Compensation Committee.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table sets forth the beneficial ownership of the Company’s Common Stock: (i) as of the Record Date, December 28, 2018,9, 2019, for each executive officer identified below (the "Named Executive Officers") and for each director, director nominee, for all directors and executive officers as a group, and (ii) stockholders of the Company owningknown to own more than 5% of the Company’s outstanding Common Stock.

| | | | | | | | |

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Ownership as a Percentage of Common Stock |

| Named Executive Officers | | |

Ken Karels (1) | 83,610 | | * |

Peter Chapman (2) | 29,961 | | * |

Doug Bass (3) | 26,548 | | * |

Karlyn Knieriem (4) | 999 | | * |

Tim Kintner (5) | 525 | | * |

Michael Gough (6) | 7,098 | | * |

| Directors and Director Nominees | | |

James Brannen (7) | 8,286 | | * |

Frances Grieb (7) | 14,425 | | * |

Thomas Henning (7) (8) | 14,806 | | * |

James Israel (7) | 6,337 | | * |

Stephen Lacy (7) (9) | 8,286 | | * |

Daniel Rykhus (7) | 14,425 | | * |

James Spies (7) | 10,508 | | * |

| Total Executive Officers and Directors as a Group (13 persons) | 225,814 | | * |

| Five Percent or Greater Stockholders | | |

BlackRock Inc. (10) | 8,409,749 | | 14.9% | |

Vanguard Group Inc. (11) | 5,977,274 | | 10.6% | |

Macquarie Group Limited (12) | 4,120,086 | | 7.3% | |

Wellington Management Group LLP (13) | 3,125,142 | | 5.5% | |

| | |

|

| | |

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Ownership as a Percentage of Common Stock |

| Named Executive Officers | | |

Kenneth Karels (1) | 95,462 | * |

Peter Chapman (2) | 21,935 | * |

Doug Bass (3) | 21,631 | * |

Michael Gough (4) | 5,277 | * |

Karlyn Knieriem (5) (6) | — | * |

Stephen Ulenberg (7) (8) | 18,636 | * |

| Directors and Director Nominees | | |

James Brannen (9) | 6,540 | * |

Frances Grieb (9) | 12,679 | * |

Thomas Henning (9) (10) | 11,060 | * |

James Israel (9) | 4,591 | * |

Stephen Lacy (9) (11) | 6,540 | * |

Daniel Rykhus (9) | 12,679 | * |

James Spies (9) | 8,762 | * |

| Total Executive Officers and Directors as a Group (14 persons) | 225,792 | * |

| Five Percent or Greater Stockholders | | |

BlackRock Inc. (12) | 7,582,407 | 13.3% |

Vanguard Group Inc. (13) | 5,914,632 | 10.4% |

Macquarie Group Limited (14) | 3,475,365 | 6.1% |

Wellington Management Group LLP (15) | 2,954,820 | 5.2% |

| | | |

* Less than 1.0% based on the 56,938,435 total outstanding shares as of December 28, 2018. |

For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Exchange Act under which, in general, a person is deemed to be the beneficial owner of a security if he or she has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he or she has the right to acquire beneficial ownership of the security within 60 days of the date of determination of ownership. Except as otherwise indicated in the notes below, all persons listed above have sole voting and investment power with respect to the shares beneficially owned by them, subject to applicable community property laws. Except as otherwise indicated, the address for each stockholder listed above is c/o Great Western Bancorp, Inc., 225 S. Main Ave, Sioux Falls, South Dakota 57104.

| |

(1) | Includes 33,800 shares of Common Stock owned by Mr. Karels' spouse, and excludes 11,603 shares of Common Stock underlying performance share units and 3,869 shares of Common Stock underlying restricted share units granted to Mr. Karels on December 2, 2016, and 6,147 shares of Common Stock underlying restricted share units granted to Mr. Karels on December 1, 2017 in accordance with the deferral requirement of the STI Plan, and 11,140 shares of Common Stock underlying performance share units and 7,427 shares of Common Stock underlying restricted share units granted to Mr. Karels on December 1, 2017, and 14,468 shares of Common Stock underlying restricted share units granted to Mr. Karels on November 30, 2018 in accordance with the deferral requirement of the STI Plan, and 13,451 shares of Common Stock underlying performance share units and 13,451 shares of Common Stock underlying restricted share units granted to Mr. Karels on November 30, 2018; all of which were granted under the Great Western Bancorp, Inc. 2014 Omnibus Incentive Compensation Plan (the "LTI Plan") and are subject to vesting. |

| |

(2) | Excludes 3,234 shares of Common Stock underlying performance share units and 1,080 shares of Common Stock underlying restricted share units granted to Mr. Chapman on December 2, 2016, and 3,104 shares of Common Stock underlying performance share units and 2,070(1) Includes 24,800 shares of Common Stock owned by Mr. Karels' spouse, and excludes 11,140 shares of Common Stock underlying performance share units and 3,714 shares of Common Stock underlying restricted share units granted to Mr. Karels on December 1, 2017, and 7,234 shares of Common Stock underlying restricted share units granted to Mr. Karels on November 30, 2018 in accordance with the deferral requirement of the STI Plan, and 13,451 shares of Common Stock underlying performance share units and 8,968 shares of Common Stock underlying restricted share units granted to Mr. Karels on November 30, 2018, and 5,101 shares of Common Stock underlying restricted share units granted to Mr. Karels on November 29, 2019 in accordance with the deferral requirement of the STI Plan, and 14,606 shares of Common Stock underlying performance share units and 14,606 shares of Common Stock underlying restricted share units granted to Mr. Karels on November 29, 2019; all of which were granted under the Great Western Bancorp, Inc. 2014 Omnibus Incentive Compensation Plan (the "LTI Plan") and are subject to vesting.

(2) Excludes 3,104 shares of Common Stock underlying performance share units and 1,036 shares of Common Stock underlying restricted share units granted to Mr. Chapman on December 1, 2017, and 2,363 shares of Common Stock underlying restricted share units granted to Mr. Chapman on November 30, 2018 in accordance with the deferral requirements of the STI Plan, |

and 4,153 shares of Common Stock underlying performance share units and 4,1532,769 shares of Common Stock underlying restricted share units granted to Mr. Chapman on November 30, 2018;2018, and 873 shares of Common Stock underlying restricted share units granted to Mr. Chapman on November 29, 2019 in accordance with the deferral requirement of the STI Plan, and 4,510 shares of Common Stock underlying performance share units and 4,510 shares of Common Stock underlying restricted share units granted to Mr. Chapman on November 29, 2019; all of which were granted under the LTI Plan and are subject to vesting.

| |

(3) | Excludes 1,966 shares of Common Stock underlying performance share units and 656 shares of Common Stock underlying restricted share units granted to Mr. Bass on December 2, 2016, and 1,887 shares of Common Stock underlying performance share units and 1,259 shares of Common Stock underlying restricted share units granted to Mr. Bass on December 1, 2017, and 859 shares of Common Stock underlying restricted share units granted to Mr. Bass on November 30, 2018 in accordance with the deferral requirements of the STI Plan, and 6,096 shares of Common Stock underlying performance share units and 6,096 shares of Common Stock underlying restricted share units granted to Mr. Bass on November 30, 2018; all of which were granted under the LTI Plan and are subject to vesting. |

| |

(4) | Excludes 444 shares of Common Stock underlying performance share units and 150 shares of Common Stock underlying restricted share units granted to Mr. Gough on December 2, 2016, and 1,035 shares of Common Stock underlying performance share units and 691 shares of Common Stock underlying restricted share units granted to Mr. Gough on December 1, 2017, and 812 shares of Common Stock underlying restricted share units granted to Mr. Gough on November 30, 2018 in accordance with the deferral requirements of the STI Plan, and 1,367 shares of Common Stock underlying performance share units and 1,367 shares of Common Stock underlying restricted share units granted to Mr. Gough on November 30, 2018; all of which were granted under the LTI Plan and are subject to vesting. |

| |

(5) | Ms. Knieriem was appointed Executive Vice President and CRO of the Company and the Bank effective June 18, 2018. |

| |

(6) | Excludes 243 shares of Common Stock underlying performance share units and 163 shares of Common Stock underlying restricted share units granted to Ms. Knieriem on December 1, 2017, and 789 shares of Common Stock underlying restricted share units granted to Mr. Knieriem on November 30, 2018 in accordance with the deferral requirements of the STI Plan, and 1,367 shares of Common Stock underlying performance share units and 1,367 shares of Common Stock underlying restricted share units granted to Mr. Knieriem on November 30, 2018; all of which were granted under the LTI Plan and are subject to vesting. |

| |

(3) Excludes 1,887 shares of Common Stock underlying performance share units and 631 shares of Common Stock underlying restricted share units granted to Mr. Bass on December 1, 2017, and 6,096 shares of Common Stock underlying performance share units and 4,065 shares of Common Stock underlying restricted share units granted to Mr. Bass on November 30, 2018, and 759 shares of Common Stock underlying restricted share units granted to Mr. Bass on November 29, 2019 in accordance with the deferral requirement of the STI Plan, and 3,637 shares of Common Stock underlying performance share units and 3,637 shares of Common Stock underlying restricted share units granted to Mr. Bass on November 29, 2019; all of which were granted under the LTI Plan and are subject to vesting. (4) Excludes 243 shares of Common Stock underlying performance share units and 83 shares of Common Stock underlying restricted share units granted to Ms. Knieriem on December 1, 2017, and 1,367 shares of Common Stock underlying performance share units and 912 shares of Common Stock underlying restricted share units granted to Ms. Knieriem on November 30, 2018, and 417 shares of Common Stock underlying restricted share units granted to Ms. Knieriem on November 29, 2019 in accordance with the deferral requirement of the STI Plan, and 2,328 shares of Common Stock underlying performance share units and 2,328 shares of Common Stock underlying restricted share units granted to Ms. Knieriem on November 29, 2019; all of which were granted under the LTI Plan and are subject to vesting. (5) Excludes 2,342 shares of Common Stock underlying restricted share units granted to Mr. Kintner on February 16, 2018, and 1,340 shares of Common Stock underlying performance share units and 894 shares of Common Stock underlying restricted share units granted to Mr. Kintner on November 30, 2018, and 168 shares of Common Stock underlying restricted share units granted to Mr. Kintner on November 29, 2019 in accordance with the deferral requirement of the STI Plan, and 1,455 shares of Common Stock underlying performance share units and 1,455 shares of Common Stock underlying restricted share units granted to Mr. Kintner on November 29, 2019; all of which were granted under the LTI Plan and are subject to vesting. (6) Excludes 1,035 shares of Common Stock underlying performance share units and 347 shares of Common Stock underlying restricted share units granted to Mr. Gough on December 1, 2017, and 1,367 shares of Common Stock underlying performance share units and 912 shares of Common Stock underlying restricted share units granted to Mr. Gough on November 30, 2018, and 270 shares of Common Stock underlying restricted share units granted to Mr. Gough on November 29, 2019 in accordance with the deferral requirement of the STI Plan, and 1,091 shares of Common Stock underlying performance share units and 1,091 shares of Common Stock underlying restricted share units granted to Mr. Gough on November 29, 2019; all of which were granted under the LTI Plan and are subject to vesting. (7) | Mr. Ulenberg retired from the Company and the Bank effective June 15, 2018. The information reported herein is based upon Mr. Ulenberg's last Form 4 filed on February 1, 2018 and additional vestings which occurred on December 3 and 4, 2018. |

| |

(8) | Excludes 2,346 shares of Common Stock underlying performance share units and 784 shares of Common Stock underlying restricted share units granted to Mr. Ulenberg on December 2, 2016, and 1,217 shares of Common Stock underlying performance share units and 812 shares of Common Stock underlying restricted share units granted to Mr. Ulenberg on December 1, 2017; all of which were granted under the LTI Plan and are subject to vesting. |

(9) Shares beneficially owned include shares of Common Stock underlying restricted share units granted to each of the identified directors under the Great Western Bancorp, Inc. 2014 Non-Employee Director Plan and which vested immediately upon grant, but have no stockholder voting rights until such shares are delivered.

(10)(8) Includes 4,5206,520 shares of Common Stock held by Mr. Henning through Henning Investments LLC.

| |

(11) | Includes 1,949 shares of Common Stock held directly by Mr. Lacy. |

| |

(12) | Based solely on information obtained from a Schedule 13G/A filed by BlackRock, Inc. ("BlackRock") with the SEC on January 19, 2018 reporting beneficial ownership as of December 31, 2017. According to this report, BlackRock's business address is 55 East 52nd Street, New York, NY 10055. BlackRock has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. BlackRock has sole voting power with respect to 7,457,392 of these shares and sole dispositive power with respect to 7,582,407(9) Includes 1,949 shares of Common Stock held directly by Mr. Lacy. (10) Based solely on information obtained from a Schedule 13G/A filed by BlackRock, Inc. ("BlackRock") with the SEC on January 28, 2019 reporting beneficial ownership as of December 31, 2018. According to this report, BlackRock's business address is 55 East 52nd Street, New York, NY 10055. BlackRock has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. BlackRock has sole voting power with respect to 8,273,776 of these shares and sole dispositive power with respect to 8,409,749 of these shares.

(11) Based solely on information obtained from a Schedule 13G/A filed by The Vanguard Group Inc. ("Vanguard") with the SEC on February 11, 2019 reporting beneficial ownership as of December 31, 2018. According to this report, Vanguard's business address is 100 Vanguard Blvd., Malvern, PA 19355. Vanguard has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. Vanguard has sole voting power with respect to 58,312 of these shares, shared voting power with respect to 6,000 of these shares, sole dispositive power with respect to 5,918,933 shares and shared dispositive power with respect to 58,341 of these shares. (12) Based solely on information obtained from a Schedule 13G filed by Macquarie Group Limited ("Macquarie") with the SEC on February 14, 2019 reporting beneficial ownership as of December 31, 2018. According to this report, Macquarie's business address is 50 Martin Place, Sydney, New South Wales, Australia. Macquarie indicated that it holds shares of our Common Stock together with certain subsidiaries. Certain Macquarie subsidiaries have sole voting power with respect to 4,105,742 of these shares and sole dispositive power with respect to 4,105,742 of these shares. (13) Based solely on information obtained from a Schedule 13G/A filed by Wellington Management Group, LLP ("Wellington") with the SEC on February 12, 2019 reporting beneficial ownership as of December 31, 2018. According to this report, Wellington's business address is 280 Congress Street, Boston, MA 02210. Wellington has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. Wellington has shared voting power with respect to 2,518,853 of these shares and shared dispositive power with respect to 3,125,142 of these shares.

|

| |

(13) | Based solely on information obtained from a Schedule 13G/A filed by The Vanguard Group ("Vanguard") with the SEC on October 10, 2018 reporting beneficial ownership as of September 28, 2018. According to this report, Vanguard's business address is 100 Vanguard Blvd., Malvern, PA 19355. Vanguard has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. Vanguard has sole voting power with respect to 57,405 of these shares, shared voting power with respect to 6,000 of these shares, sole dispositive power with respect to 5,857,198 shares and shared dispositive power with respect to 57,434 of these shares. |

| |

(14) | Based solely on information obtained from a Schedule 13G filed by Macquarie Group Limited ("Macquarie") with the SEC on February 14, 2018 reporting beneficial ownership as of December 31, 2017. According to this report, Macquarie's business address is 50 Martin Place, Sydney, New South Wales, Australia, Macquarie indicated that it holds shares of our Common Stock together with certain subsidiaries. Certain Macquarie subsidiaries have sole voting power with respect to 3,465,969 of these shares and sole dispositive power with respect to 3,465,969 of these shares. |

| |

(15) | Based solely on information obtained from a Schedule 13G/A filed by Wellington Management Group, LLC ("Wellington") with the SEC on February 8, 2018 reporting beneficial ownership as of December 31, 2017. According to this report, Wellington's business address is 280 Congress Street, Boston, MA 02210. Wellington has indicated that it holds shares of our Common Stock together with certain of its subsidiaries. Wellington has shared voting power with respect to 2,403,049 of these shares and shared dispositive power with respect to 2,954,820 of these shares. |

RELATED PARTY TRANSACTIONS

Related Party Transactions

We, our Bank or one of our other subsidiaries may occasionally enter into transactions with certain “related persons.” Related persons include our executive officers, directors, nominees for director, 5% or more beneficial owners of our Common Stock, immediate family members of these persons and entities in which one of these persons has a direct or indirect material interest. We generally refer to transactions with these related persons as “related party transactions.”

Related Party Transaction Policy

Our Board has adopted a written policy governing the review and approval of transactions with related parties that will or may be expected to exceed $120,000 in any fiscal year. The policy calls for the related party transactions to be reviewed and, if deemed appropriate, approved by our Audit Committee. Upon determination by the General Counsel of the Company that a transaction requires review under the policy, the material facts are to be presented to the Audit Committee. In determining whether or not to approve a related party transaction, our Audit Committee will take into account, among relevant other factors, whether the related party transaction is in our best interests, whether it involves a conflict of interest and the commercial reasonableness of the transaction. In the event a member of our Audit Committee is not disinterested with respect to the related party transaction under review, that member may not participate in the review, approval or ratification of that related party transaction.

Certain decisions and transactions are not subject to the related party transaction approval policy, including: (i) decisions on compensation or benefits relating to directors or executive officers and (ii) loans from our Bank or other indebtedness owing to us made in the ordinary course of business, on substantially the same terms, including interest rate and collateral, as those prevailing at the time for comparable loans with persons not related to us and not presenting more than the normal risk of collectability or other unfavorable features.

Other Related Party Transactions

In the ordinary course of our business, we or our Bank have engaged and expect to continue engaging in ordinary banking transactions with our directors, executive officers, their immediate family members and companies in which they may have a 5% or more beneficial ownership interest, including loans to such persons. Any loan to a related party was made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans made to persons who were not related to us. These loans do not involve more than the normal credit collection risk and do not present any other unfavorable features.

DELINQUENT SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEREPORTS